What is the best practice for coding organization records, especially when considering CASE reporting?

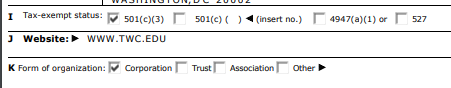

One example I am looking at in our system is the The Washington Center, on their website it states they are a non-profit organization and when I look at the 990 they are a 501( c)(3) and a corporation:

Would you code them as a non-profit in your system or would you code them as a corporation?

We are in the midst of a massive cleanup of our system and I want to be sure we are coding these non-person records correctly!

Thank you,

Amanda

Amanda L. Haney

Director of Gift & Data Management

Gift & Data Management

University Advancement I Elliott Alumni Center I 9 Edgewood Rd I Durham, NH 03824

Office: 603-862-2041 I amanda.haney@unh.edu

CONFIDENTIALITY NOTICE: If you have received this email in error, please immediately notify the sender by e-mail at the address shown. This e-mail transmission may contain confidential information. This information is intended only for the use of the individual(s) or entity to whom it is intended even if addressed incorrectly. Please delete it from your files if you are not the intended recipient. Thank you for your compliance.